Tax Filing with

VITA Tax Assist

Choose from one of these options:

2456805

DOLLARS SAVED IN TAX-PREPARATION FEES IN 2024

17097863

DOLLARS IN TAX REFUNDS

“

[VITA] helped me acquire more knowledge about my tax benefits. I really loved it, because not only are you learning but helping your community is the best feeling.

Veronica Soto

, Community Member

“

It is a great service; everyone is very professional and well trained. I am grateful I found this service.

Susana Garcia

, Community Member

“

The VITA program has helped me in every way. It has been like a gift, and I couldn’t be happier with the service.

Maria Marin

, Community Member

WHAT IS EITC?

EARNED INCOME TAX CREDIT

Earned Income Tax Credit (EITC) is a benefit for working families that helps reduce the amount of tax that they owe and may even give them a refund. To qualify, you must have earned income and meet some basic requirements. You can even file your taxes from up to three years ago free of charge if you think that you might have qualified! In 2024, VITA helped claim more than $6.3 million in Earned Income Tax Credits. Ask your VITA volunteer if you qualify!

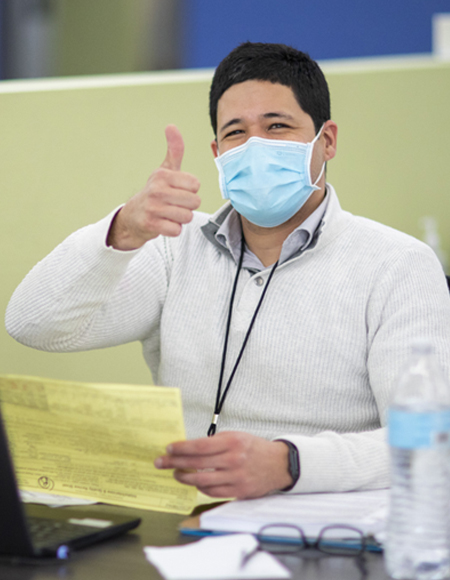

OUR VOLUNTEERS

Our trained, bilingual IRS volunteers are ready to help you file your taxes!